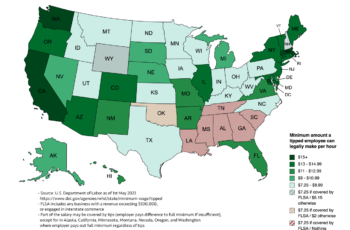

Minimum amount a tipped employee can legally make per hour

by u/xetal1

Source: U.S. Department of Labor, “Minimum Wages for Tipped Employees”, as of 1st May 2023. https://www.dol.gov/agencies/whd/state/minimum-wage/tipped

Tip credit:

Most states employ a tip credit system. This means that part of the

salary (how large part varies by state, see source above) may be covered

by tips. However, the total wage (salary + tips) must exceed the total

minimum or the employer is eligible to pay the difference. States not

using this are Alaska, California, Minnesota, Montana, Nevada, Oregon,

and Washington, where the employer must pay out the full amount on top

of any tips.

Fair Standards Labor Act (FLSA):

Some states (Alabama, Louisiana, Mississippi, South Carolina,

Tennessee, Georgia, Oklahoma, and Wyoming) have no state minimum wage or

a state minimum wage lower than set out in the FLSA. Any business with a

yearly revenue exceeding $500,000, or engaged in interstate commerce is

covered by the minimums set out in this act.