One mother has some very strong words for Sallie Mae, the student loan lender.

In a viral TikTok video with more than 53,000 views, user Stacy (@stacyann370) explained why she believes the lender is predatory to students and she used some pretty strong language to make her point.

@stacyann370 Kkisa trying to get an education shoulsnt have to pay four times the amount back, putting them in debt for 40-plus years so the bank CEO cab have five vacation homes, its om when big companies get loans forgiven but so many complain about kids getting forgiveness from predatory loans ##salliemae##college##bankloans##settingkidsupforfailure##enough ♬ original sound – Stacy

“F**k you Sallie Mae,” the mom began the video.

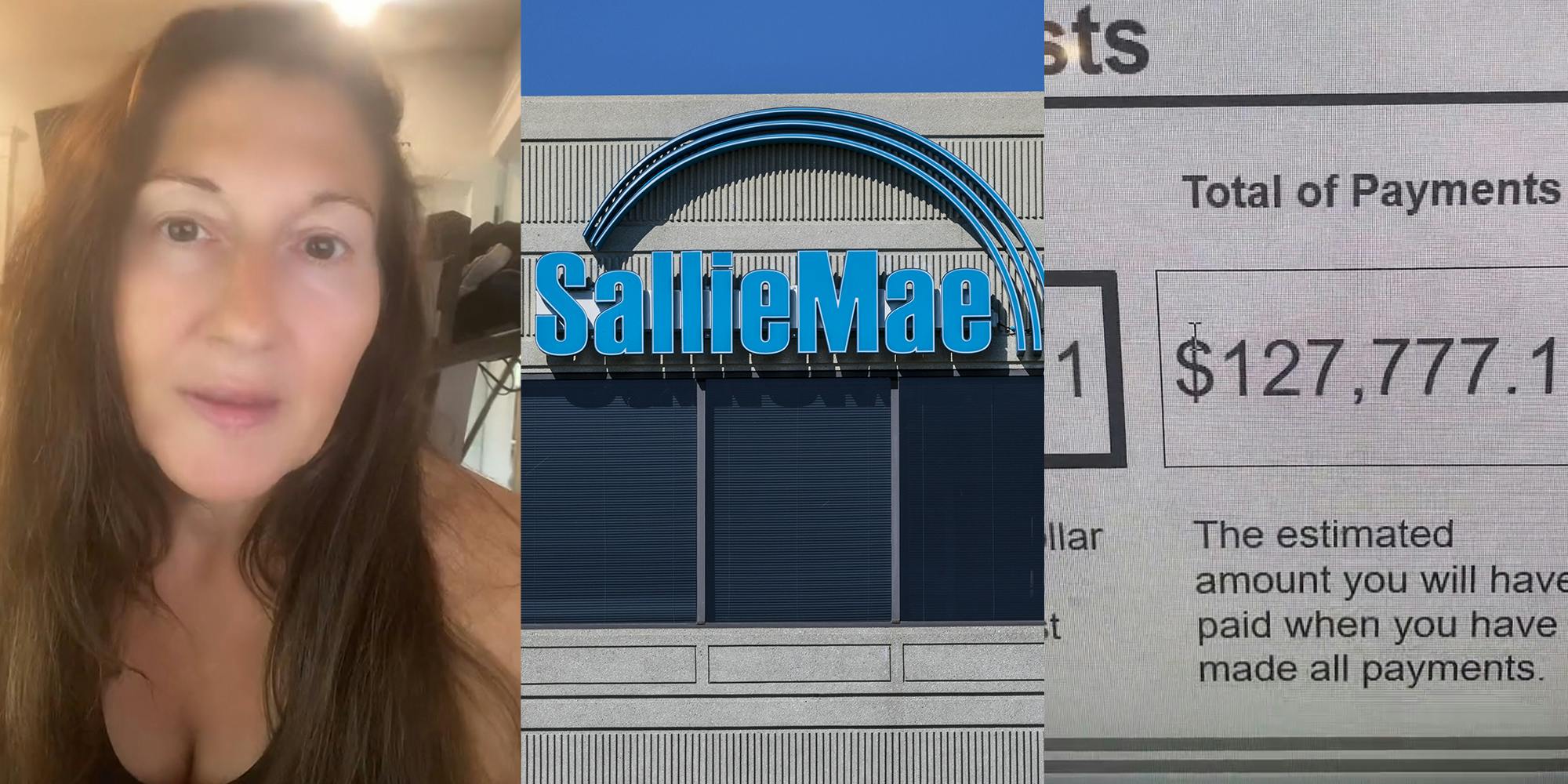

Her anger stems from the apparent predatory nature of student loans. In the clip, she shared a screen that showed the apparent terms of a loan to finance her daughter’s college education that included a 16.53% interest rate charge. According to Sallie Mae’s website, interest rates are calculated based on borrowers credit history, cosigner credit history, and what type of repayment option is chose, among other factors.

“Everybody can see what these predatory banks have been doing to children and kids that have just been trying to get a f*****g education.”

Based on the 16% interest rate charged by the bank and initial loan amount of $28,355 the apparent total to finance the loan would be $99,422.11.

“So to borrow $28,000, Sallie Mae, that b*tch, wants to give my 19-year-old an interest rate of 16%,” the mom explained. “When my 19-year-old daughter would have to pay this back, she would have to pay Sallie Mae $127,000.”

Stacy explained that the loan would only cover one year of her daughter’s tuition and, as a sophmore, she would likely have to take out even more loans to pay for the remaining years of college.

In the comments section, many shared similar upsetting loan stories.

“And I would have absolutely no problem paying off just the amount I borrowed!” user Bee wrote. “It’s the interest I can’t pay off.”

“Interest rates are absolutely criminal,” user Stephanie Matz wrote. “In the housing market now too. Why don’t we have protections against this?!”

“I paid my $60k student loan from 2008-2019 at 6%, balance was $65,000,” another user shared.

“6% interest rate is like a credit card!!!” yet another wrote.

The Supreme Court recently issued a blow that blocked President Joe Biden’s student loan relief plan that would’ve provided loan forgiveness of up to $20,000 per borrower. Loan and interest repayments for student borrowers were paused multiple times by the U.S. Department of Education’s COVID-19 relief plan, but that ended on Sept. 1, according to NBC News. Interest have since begun to accrue and payments on loans will come due next month, in October. Many, however, anticipate young Americans will struggle with resuming payments.

The Daily Dot reached out to Sallie Mae via email and Stacy via TikTok comment.

Sign up to receive the Daily Dot’s Internet Insider newsletter for urgent news from the frontline of online.

Source: https://www.dailydot.com/news/sallie-mae-student-loan-interest/